Credit Education

What is a Credit Score?

A credit score is a number generated by a mathematical formula that is meant to predict creditworthiness. Credit scores range from 300-850. The higher your score is, the more likely you are to get a loan. The lower your score is, the less likely you are to get a loan. If you have a low credit score and you do manage to get approved for credit then your interest rate will be much higher than someone who had a good credit score and borrowed money. Therefore, having a high credit score can save many thousands of dollars over the life of your mortgage, auto loan, or credit card.

Credit Scores and Their Ranges

800 – 850 (Excellent) With a credit score in this range no lender will ever disapprove your loan application. Additionally, the APR (Annual Percentage Rate) on your credit cards will be the lowest possible. You’ll be treated as royalty. Achieving this excellent credit rating not only requires financial knowledge and discipline and, but also a good credit history. Generally speaking, to achieve this excellent rating you must also use a substantial amount of credit on an ongoing monthly basis and always repay it ahead of time.

700 – 799 (Very Good) 27% of the United States population belongs to this credit score range. With this credit score range, you will enjoy good rates and be approved for nearly any type of credit loan or personal loan, whether unsecured or secured.

680 – 699 (Good) This range is the average credit score. In this range, approvals are practically guaranteed but the interest rates might be marginally higher. If you’re thinking about a long-term loan such as a mortgage, try working to increase your credit score higher than 720 and you will be rewarded for your efforts – your long-term savings will be noticeable.

620 -679 (OK or Fair) Depending on what kind of loan or credit you are applying for and your credit history, you might find that the rates you are quoted aren’t the best. That doesn’t mean that you won’t be approved but, certain restrictions will apply to the loan’s terms.

580 – 619 (Poor) With a poor credit rating you can still get an unsecured personal loan and even a mortgage, but, the terms and interest rates won’t be very appealing. You’ll be required to pay more over a longer period of time because of the high interest rates.

500 – 579 (Bad) With a score in this range you can get a loan but nothing even close to what you expect it to be. Some people with bad credit apply for loans to consolidate debt in search of a fresh start. However, if you decide to do that then proceed cautiously. With a 500 credit score, you need to make sure that you don’t default on payments or you’ll be making your situation worse and might head towards bankruptcy, which is not what you want.

499 and Lower (Very Bad) If this is your score range you need serious and professional assistance with how you handle your credit. You’re making too many credit blunders and they will only get worse if you don’t take positive action. If you are thinking of a loan then keep in mind that if you do find a sub-prime lender (which won’t be easy), the rates will be very high and the terms will be very strict. We recommend that you fix your credit and only then move on to applying for a loan.

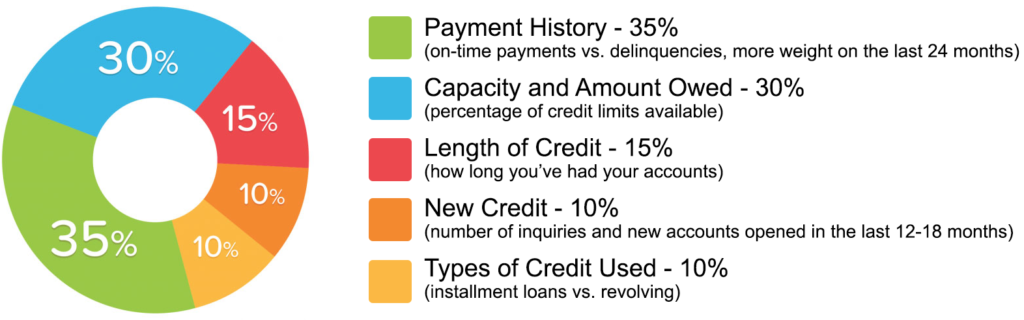

How do credit bureaus determine my credit score?

35% – Payment History

30% – Debt Ratio

15% – Length of Credit History

10% – Types of Credit

10% – Number of Credit Inquiries

The percentages in this chart show how important each of the categories is in determining your Credit score. We will help you to remove negative items from your payment history. We will also show you how to maximize your debt ratio score, even if paying off credit cards is not an option.

Scoring models generally evaluate the following types of information in your credit report:

- Do you pay your bills on time? Payment history is a major factor in credit scoring. If you have paid bills late, have collections, or declared bankruptcy, these events will not reflect well in your credit score.

- Do you have a long credit history? Generally speaking, the longer your history of holding accounts is, the more trusted you will be as a borrower.

- Have you applied for credit recently? If you have many recent inquiries this can be construed as being negative by the credit reporting agencies. Only apply for credit when you really want it.

- What is your outstanding debt? It is important that you are not using all of your available credit. If all of your credit cards are maxed out, your scores will reflect that you are not managing your debt wisely.

What is the secret to a high credit score?

- Always pay your bills on time!

- Don’t close old accounts!

- Don’t apply for any new credit!

- Don’t ever use more than 25% of your available credit on each credit card!

What happens if you are denied credit or don’t get the terms you want?

If you are denied credit, the Equal Credit Opportunity Act requires that the creditor give you a notice that tells you the specific reasons your application was rejected or the fact that you have the right to learn the reasons if you ask within 60 days. Indefinite and vague reasons for denial are illegal, so ask the creditor to be specific. Acceptable reasons include: “Your income was low” or “You haven’t been employed long enough.” Unacceptable reasons include: “You didn’t meet our minimum standards” or “You didn’t receive enough points on our credit scoring system.”

If a creditor says you were denied credit because you are too near your credit limits on your charge cards or you have too many credit card accounts, you may want to reapply after paying down your balances or closing some accounts. Credit scoring systems consider updated information and change over time.

If you’ve been denied credit, or didn’t get the rate or credit terms you want, ask the creditor if a credit scoring system was used. If so, ask what characteristics or factors were used in that system, and the best ways to improve your application. If you get credit, ask the creditor whether you are getting the best rate and terms available and, if not, why. If you are not offered the best rate available because of inaccuracies in your credit report, be sure to dispute the inaccurate information in your credit report.

Get Started Today!

What kind of information do credit bureaus collect and sell?

Credit bureaus collect and sell four basic types of information:

- Identification and employment information Your name, birth date, Social Security number, employer, and spouse’s name are routinely recorded in your credit report. They may also provide information about your employment history, home ownership, income, and previous address if a creditor requests this type of information.

- Public record information Events that are a matter of public record, such as bankruptcies, foreclosures, or tax liens, may appear in your report.

- Inquiries CRAs must maintain a record of all creditors who have asked for your credit history within the past year. It is generally beneficial to keep the number of inquiries as low as possible.

- Payment history Your accounts with different creditors are listed, along with the balances, high balances, and outstanding balances. Related events, such as referral of an overdue account to a collection agency, charge-off accounts or other delinquencies may also be noted.

How long will certain items remain on my credit file?

Delinquencies (30–180 days): A delinquency may remain on your credit report for seven years from the date of the initial missed payment that led to the delinquency.

Collection Accounts: Collection accounts remain on your credit report for seven years from the date of the initial missed payment that caused the account to be sent to collections (the original delinquency date). If a collection account is paid in full, it will be marked as a “paid collection” on your report but will still stay on file for the same duration.

Charge-Off Accounts: A charge-off occurs when a creditor writes off a delinquent account as a loss and may also send it to collections. Charge-offs remain for seven years from the original delinquency date, even if payments are later made on the account.

Closed Accounts:

With Delinquencies: Closed accounts with delinquent payments remain on your credit report for seven years from the original delinquency date.

Without Delinquencies: Positive closed accounts remain on your credit report for ten years from the closing date.

Closed accounts may show a zero balance or reflect an outstanding balance, depending on their status at closure.

Lost Credit Cards: If there are no delinquencies, credit cards reported as lost will appear on your credit report for two years from the date the creditor was notified. Any delinquencies that occurred before the card was reported lost will remain for seven years.

Bankruptcy:

Chapter 7, 11, and 12 Bankruptcies: These are reported for ten years from the filing date.

Chapter 13 Bankruptcy: This remains on your report for seven years from the filing date.

Accounts Included in Bankruptcy: Individual accounts included in the bankruptcy remain on your report for seven years from the date they were reported as part of the bankruptcy.

Judgments: Judgments remain on your credit report for seven years from the filing date.

City, County, State, and Federal Tax Liens:

Unpaid Tax Liens: These remain for fifteen years from the filing date.

Paid Tax Liens: These remain for ten years from the date of payment.

Inquiries:

General Inquiries: Most inquiries remain on your credit report for two years.

Soft Inquiries (e.g., employment or pre-approved credit offers): These are visible only on personal credit reports pulled by you and are not factored into credit decisions.

Minimum Duration: All inquiries must remain on your credit report for at least one year from the inquiry date.

Client Information and Recommendations:

As your credit consultant, our goal is to guide you in improving your credit and achieving your financial goals. Whether you choose to work with us directly or use the tools and resources we provide, we are here to support you every step of the way.

Credit repair is completely legal, and there are laws in place to protect consumers. One key law is the Fair Credit Reporting Act (FCRA), which gives you the right to dispute any item on your credit report. If an item cannot be verified within a reasonable time (typically 30-45 days), it must be removed. Even accurate negative items can sometimes be removed or negotiated under certain circumstances. This law is the foundation of credit repair and the basis of the services and tools we offer.

Your credit payment history and profile make up your credit report. These reports, maintained by consumer reporting agencies (commonly known as credit bureaus), track your financial activity. The three largest credit bureaus are TransUnion, Equifax, and Experian. You have a credit record with these agencies if you have ever applied for a credit or charge account, a personal loan, or even a job. Your credit record contains information about your income, debts, and credit payment history. It may also include details about defaults, outstanding judgments, child support obligations, or bankruptcies.

No matter where you are on your financial journey, we are here to help you take the next step toward better credit and greater financial freedom.

How can I speed up the process?

Following these 7 steps will increase your score quickly.

Order fresh new copies of your credit reports from all 3 bureaus: Equifax, Experian, and TransUnion.

Credit reports are constantly changing. Therefore it is important to have up-to-date copies. A good rule of thumb to know is: If a creditor runs your score or reports, this will hurt your score. However, if you order your own credit reports (which we will help you with) your score will not be affected. You also may want to sign up for credit monitoring to see your reports and scores and track changes as they happen.

Correct all inaccuracies on your Credit Reports. We will assist you with this step.

Go through your credit reports very carefully. Especially look for; Late payments, charge-offs, collections, or other negative items that aren’t yours, Accounts listed as “settled,” “paid derogatory,” “paid charge-off” or anything other than “current” or “paid as agreed” if you paid on time and in full, Accounts that are still listed as unpaid that were included in a bankruptcy, Negative items older than seven years (10 in the case of bankruptcy) that should have automatically fallen off your report (you must be careful with this last one because sometimes scores actually go down when bad items fall off your report. It’s a quirk in the FICO credit-scoring software, and the potential effect of eliminating old negative items is difficult to predict in advance). Also, make sure you don’t have duplicate collection notices listed. For example; if you have an account that has gone to collections, the original creditor may list the debt, as well as the collection agency. Any duplicates must be removed! Make sure that your proper credit lines are posted on your Credit Reports. Often, to make you less desirable to their competitors, some creditors will not post your proper credit line. Showing less available credit can negatively impact your credit score. If you see this happening on your credit report, you have a right to complain and bring this to their attention. If you have bankruptcies that should be showing a zero balance…make sure they show a zero balance! Very often the creditor will not report a “bankruptcy charge-off” as a zero balance until it’s been disputed.

If you have any negative marks on your credit report, negotiate with the creditor or lender to remove it. *We will assist you with this step.

If you are a long-time customer and it’s something simple like a one-time late payment, a creditor will often wipe it away to keep you as a loyal customer. Sometimes they will do this if you call and ask. However, if you have a serious negative mark (such as a long overdue bill that has gone to collections), always negotiate a payment in exchange for the removal of the negative item. Always make sure you have this agreement with them in writing. Do not pay off a bill that has gone to collections unless the creditor agrees in writing that they will remove the derogatory item from your credit report. This is important; when speaking with the creditor or collection agency about a debt that has gone to collections, do not admit that the debt is yours. Admission of debt can restart the statute of limitations and may enable the creditor to sue you. You are also less likely to be able to negotiate a letter of deletion if you admit that this debt is yours. Simply say “I’m calling about account number ________” instead of “I’m calling about my past due debt.” Again, as your credit specialist, we will help you with this step.

Pay all credit cards and any revolving credit down to below 30% of the available credit line.

This step alone can make a huge impact on your score. The credit scoring system wants to make sure you aren’t overextended, but at the same time, they want to see that you do indeed use your credit. 30% of the available credit line seems to be the magic “balance vs. credit line” ratio to have. For example; if you have a Credit Card with a $10,000 credit line, make sure that never more than $3000 (even if you pay your account off in full each month). If your balances are higher than 30% of the available credit line, pay them down. Here is another thing you can try; ask your long-time creditors if they will raise your Credit Line without checking your FICO score or your Credit Report. Tell them that you’re shopping for a house and you can’t afford to have any hits on your credit report. Many will not but some will.

Do not close your old credit card accounts.

Old established accounts show your history and tell about your stability and paying habits. If you have old credit card accounts that you want to stop using, just cut up the cards or keep them in a drawer, but keep the accounts open.

Avoid applying for new credit.

Do not apply for any new credit! Each time you apply for new credit, your credit report gets checked. New credit cards will not help your credit score and a credit account less than one year old may hurt your credit score. Use your cards and credit as little as possible until the next credit scoring.

Have at least three revolving credit lines and one active (or paid) installment loan listed on your Credit Report.

The scoring system wants to see that you maintain a variety of credit accounts. It also wants to see that you have 3 revolving credit lines. If you do not have three active credit cards, you might want to open some (but keep in mind that if you do, you will need to wait sometime before rescoring). If you have poor credit and are not approved for a typical credit card, you might want to set up a “secured credit card” account. This means that you will have to make a deposit that is equal to or more than your limit, which guarantees the bank that you will repay the loan. It’s an excellent way to establish credit. Examples of an installment loan would be a car loan, or it could be for furniture or a major appliance. In addition to the above, having a mortgage listed will bring your score even higher.

Throughout this process, always remember:

It takes up to 30 Days for any of these items to get reported and often longer to reflect on your Credit History Reports. Very often we must write a series of letters challenging the credit bureaus. Each time we must allow them 30-45 days to respond. It can feel like a slow process, but hang in there because it does work and the end result will save you a tremendous amount of money.